(+34) 900 861 374 Mon-Fri: 8:00 to 18:00

(+34) 900 861 374 Mon-Fri: 8:00 to 18:00

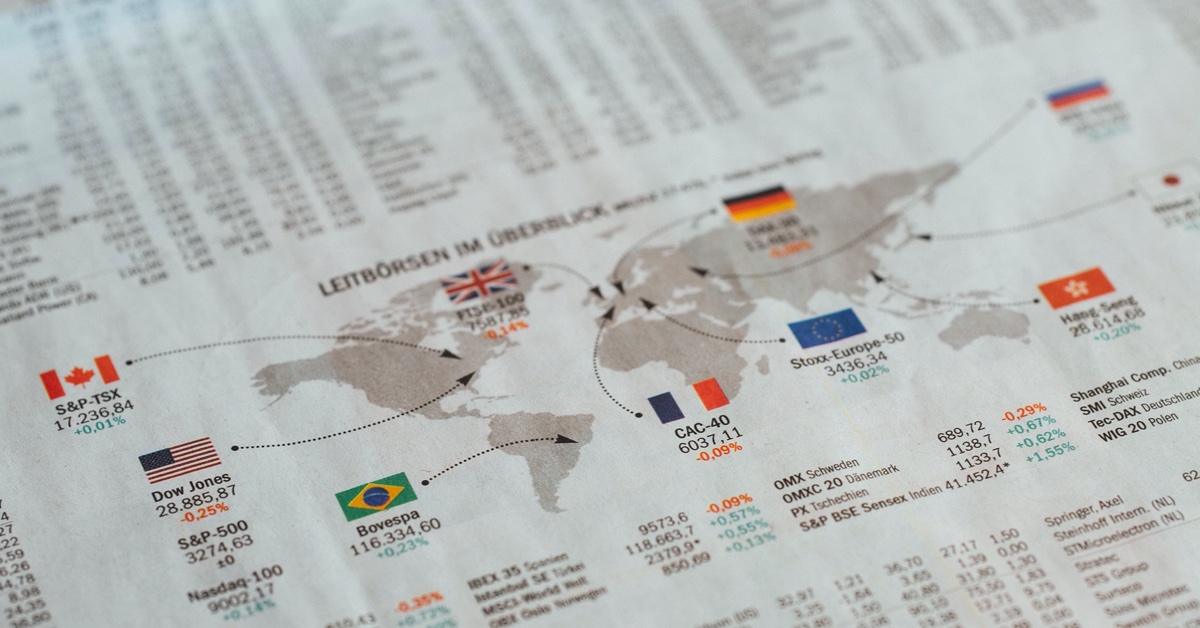

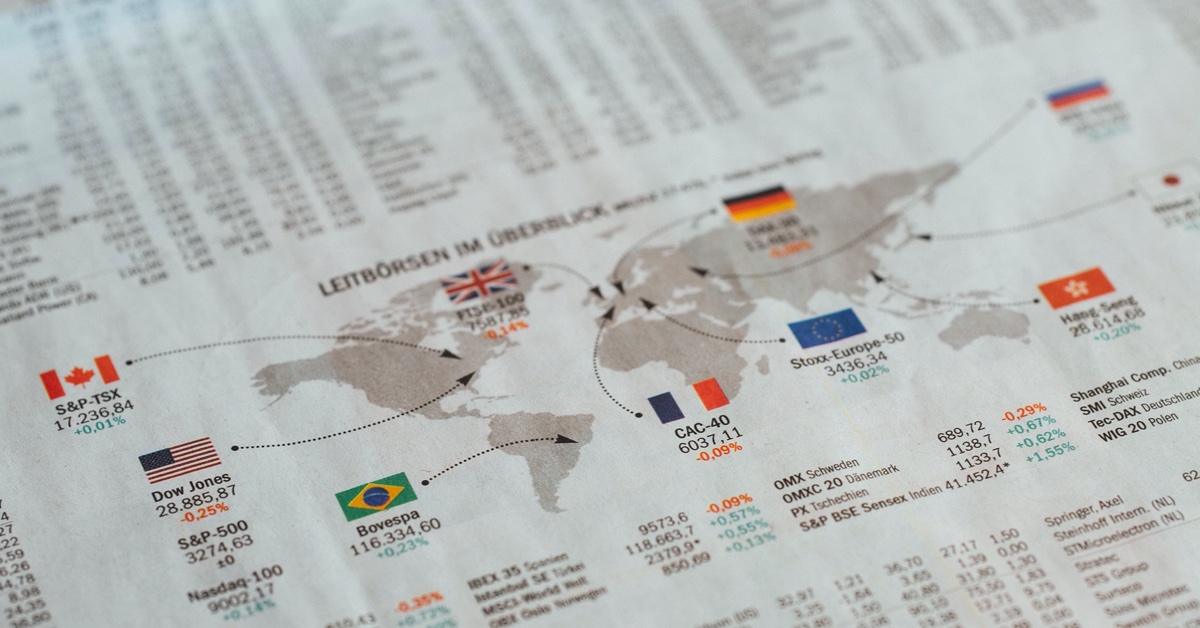

While the current economic cycle seems to stretch further and the probability of a significant downturn in the next 6 months remains low, many global signs of a decelerating economy have appeared. Growth cooled down (slightly) in the US and EM, China is spooked by the coronavirus, and Europe (and Japan are not growing).

The Old Continent grew just 0.1% in Q4 2019 – the slowest since the last debt crisis. Industrial production is the lowest in almost 4 years and retail sales dropped by most in a decade.

Germany, Europe’s largest economy, flatlined in Q4 and is particularly affected by a series of global issues including the US-China trade wars. On top of that, the coronavirus affects Europe’s production capabilities in China, a new macro element we have to factor in.

On the other side of The Channel, Brexit (now almost coined a swear word!) actually happened. Going forward, Britain will have more freedom to operate in the global economy as it wishes, but that doesn’t make it necessarily easier. Case in point: the US reaction to the UK’s decision to include Huawei (=China) in the development of the 5G network is a representative foretaste of how post-Brexit trade negotiations will be held. US republicans already indicated that the 5G deal would make US-UK bilateral trade deals more “problematic”.

Trade wars will remain the headline grabbing theme during 2020. Nonetheless, as expected, they cooled down (a bit). In the China-US phase one deal, China cut tariffs on $75 billion worth of American imports in half. The US announced it will reciprocate by halving tariffs on certain Chinese goods, too.

What is driving the US and China to reconcile agreement? Besides Trump’s willingness to find the “best trade deal ever” in anticipation of the US elections, China is suspected to limit the economic damage from the recent corona epidemic by being more pragmatic in its global trade relations. The US seems to increasingly focus the discourse on intellectual property, also a major topic in the political campaign.

Back at home, China injected $200 billion in its slowing economy and slashed interest rates to make borrowing cheaper, encouraging spending and hopefully leading to more growth. And its economy needs growth: oil consumption is falling quickly, affecting the global oil prices strongly.

The third largest economy is shrinking and Q4 was the quarter it shrank at the fastest rate since 2014. Following a newly introduced sales tax in October, consumer spending dropped 11% during Q4. The situation will almost certainly be aggravated by the impact caused by the coronavirus as global trade and travel slows down.

Iran is a modern country with so much potential, fantastic hospitality, and an incredibly rich heritage. Sipping pomegranate juices in the gardens of the legendary Abassi Hotel or visiting the magnificent Goslatan Palace and Grand Bazaar in Tehran should be on your bucket list.

Unfortunately, Iran will not become a major tourist destination anytime soon.

US-Iran tensions escalated following the Soleinmani killing, one of Iran’s main leaders. Iran responded by announcing that it will no longer comply with the nuclear deal and retaliate the attack.

NEED HELP?

VISIT OUR FAQ PAGE AND EXPLORE ALL THE ANSWERS ABOUT NOVICAP YOU ARE LOOKING FOR